Helping You Be Prepared

As members of the Duquesne University community, eligible faculty and staff members enjoy comprehensive benefits designed to support both personal and family well-being. These benefits encompass medical, dental and vision coverage, flexible spending accounts, employer paid life insurance and long-term disability benefits.

You can enhance your physical, mental and financial health by utilizing our on-campus workout facility, participating in wellness initiatives and accessing tuition benefits.

Duquesne University prioritizes your future, to. Your retirement plan is a crucial component of your compensation and long-term financial stability. The Duquesne University Plan offers matching contributions, provided you meet eligibility criteria. Both the University's contributions and your own are fully vested from the outset, and the plan remains entirely portable should you leave the University.

Matching funds become available after your one-year anniversary with the University. In some cases, the one-year waiting period may be waived if you have prior experience at a qualifying educational institution in an eligible role. To confirm your eligibility, please complete the Prior Year of Service Form.

2025-2026 Benefits Overview Guide

To obtain plan details and costs, refer to the Benefits Overview Guide. Faculty and staff have the opportunity to utilize: These benefits are optional and are funded by the employees themselves. Duquesne University is committed to employee financial well-being, offering a retirement

plan that helps employees prepare for and build long-term financial security. The Roth 403(b) is a part of the University's retirement plan and provides eligible

employees with an option to make voluntary contributions on an after-tax basis. What is a 457(b) plan? The University also offers a 457(b) Retirement plan for eligible employees. This plan

is a non-qualified, tax advantaged, deferred compensation retirement plan that is

used to provide an additional opportunity for pre-tax contributions for eligible employees. Department of Labor regulations require the University to provide detailed information

about investment options and expenses associated with these investments.Duquesne University Benefit Options

To obtain plan details and costs refer to the Benefits Overview Guide.

Optional term life insurance provides extra security for individuals who are financially dependent on you. The

amount you require can differ based on factors such as your age, the number and ages

of your dependents, as well as your financial circumstances. This is an optional benefit,

and is employee paid.

Spouse and Child optional life insurance also offers financial protection when the unexpected happens. This is an optional

benefit and is employee paid.

Basic long-term disability (LTD) is provided by the University after completion of 1-year of full-time employment.

This benefit provides 50% of base salary to a maximum benefit of $5,000 per month.

Buy-Up long-term disability provides an additional 10% of coverage. When added to Basic LTD, coverage is 60%

of base salary to a maximum of $12,000 per month. This is an optional benefit and

is employee paid.

The University has partnered with Highmark, UPMC and The Center for Pharmacy Care

to offer this program.

Members can earn Wellness in Motion Dollars for each wellness activity that is completed.

Highmark PPO members receive Wellness in Motion Dollars in a health reimbursement

account (HRA). Dollars in this account are automatically applied to medical deductibles

and co-insurance.

UPMC EPO members receive Wellness in Motion Dollars on an UPMC Consumer Advantage

debit card. Participating members will receive this card shortly after the start

of the plan year. This card can be used for services that go toward the deductible

and co-insurance.

Employees and their participating spouse can each earn up to $300 in Wellness in Motion

Dollars.Retirement Plan

Duquesne University's Match Contribution

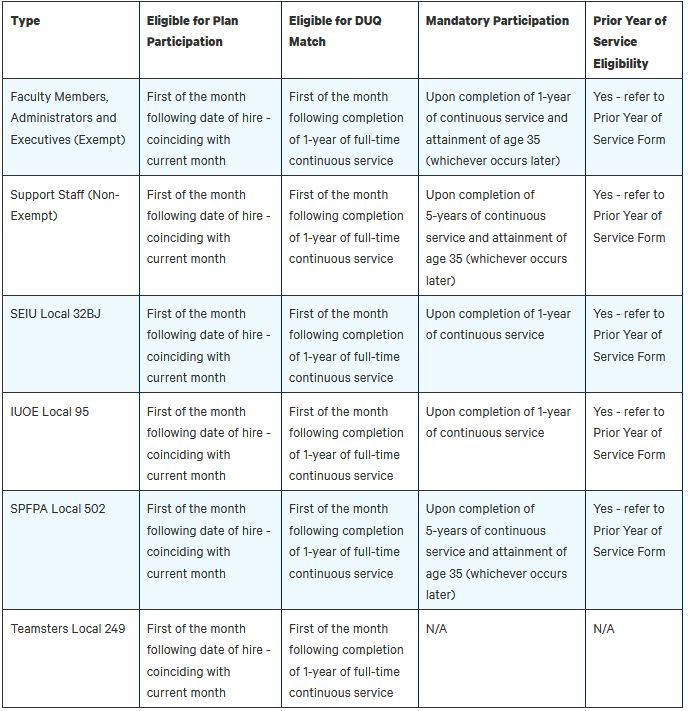

The University offers a match. Eligibility for the match is based on employment status

as outlined in the chart below.

Yes, the Duquesne University plan will accept rollovers from other pre-tax sources.

What is the maximum amount that I can contribute?

Federal tax law limits the amount you can contribute. The limit for calendar year

2025 is $23,500 with an additional $7,500 catch-up for those age 50 and above. A

NEW catch-up provision allows those who will be, or are ages 60-63, $11,500 in catch-up

contributions.

Are the any other voluntary contribution options?

Yes, employees have the ability to contribute their own money to a University sponsored

Roth 403(b) Plan. Eligible employees have he option of electing after-tax contributions

through payroll deductions into the Roth 403(b) voluntary contribution option under

the Duquesne University 403(b) Defined Contribution Retirement Plan.

Are there any loan features associated with the Duquesne University Retirement Plan?

Yes, employees may take a maximum of two loans based on all accumulations.

The salary threshold to participate in this plan must meet the IRS definition of a

highly compensated individual. For 2025 the IRS definition of a highly compensated

individual is $160,000.

For more information about this plan please reach out to the Benefits Office or a

TIAA financial advisor at 800-732-8353.

Qualified Default Investment Alternative (QDIA) Initial Notice

Summary Annual Report

Duquesne University 403(b) Retirement Plan Summary Annual Report

Summary Plan Description

Duquesne University 403(b) Defined Contribution Retirement Plan Summary Plan Description

Universal Availability

Duquesne University 403(b) Retirement Plan Universal Availability

Plan and Investment Notices

TIAA Plan and Investment Notice

Valic Plan and Investment Notice

The disclosure gives plan participants a complete picture of all the funds and associated

expenses available. The disclosure is for informational purposes only.

The information includes: